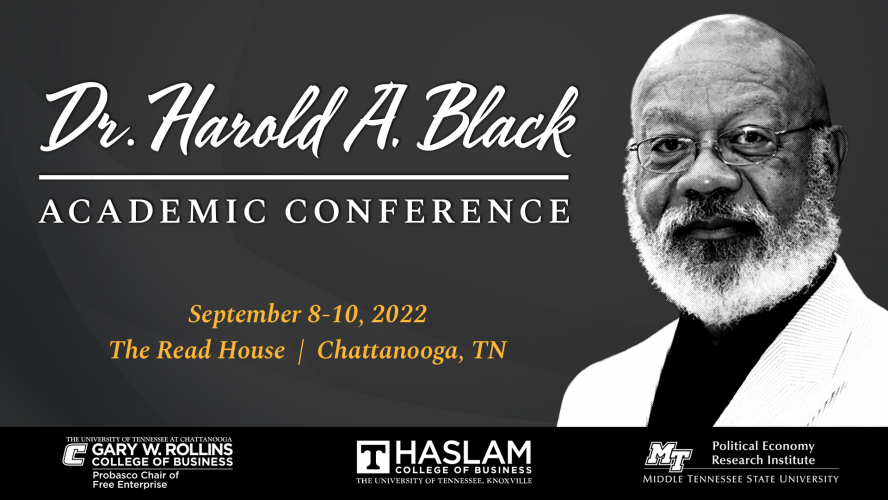

Dr. Harold A. Black Academic Conference

The Probasco Distinguished Chair of Free Enterprise at the University of Tennessee Chattanooga, the Haslam College of Business at the University of Tennessee Knoxville, and the Political Economy Research Institute at Middle Tennessee State University were pleased to host an academic conference to honor and build upon the important scholarship of Dr. Harold A. Black. Professor Black is Professor Emeritus at the Haslam College of Business at the University of Tennessee, Knoxville.

The conference took place Sept. 8-10, 2022 at the Read House in Chattanooga, TN. Papers presented at the conference directly build on, examine, or extend the scholarship of Dr. Black. Accepted papers will be considered for a special issue of Public Choice. Authors of accepted papers received an honorarium to attend the conference (coauthored papers received support for only one author). Final paper submissions for consideration for Public Choice will be due Jan. 8, 2023.

Research background: Harold Black’s research has deep connections to the literature in public choice on race and discrimination (Magness 2020). The primary emphasis of much of Black’s research is examining the prevalence and effects of discrimination in the financial industry. The perception that racial discrimination was systemic in financial markets motivated many regulations. Black’s seminal paper with Schweitzer and Mandel (1978) was one of the first econometric tests for bias in lending decisions and one of the first to employ logistic regression analysis in financial economics research. Black uses careful empirical work to provide a deeper understanding of when and where discrimination occurs in the financial industry, finding that, at least in some cases, regulations intended to help minority groups ended up harming them.

Black, Collins, and Cyree (1997) and Black, Robinson, and Schwitzer (2001), for instance, find that black-owned banks may themselves discriminate against African-American and low-income borrowers. His results suggest that aside from discrimination, alternative factors may be driving some of the statistical differentials in outcomes between races. In another example, Black (1999) argues that lending regulations in the Community Reinvestment Act and the Home Mortgage Disclosure Act could lead to financial institutions extending loans to financially unqualified borrowers to reduce their rejection rates of minority groups. But this may further damage the credit histories of individuals who already have poor credit histories in the event of default. Black, DeGennaro, and Boehm (2003), in the Journal of Banking and Finance, find that banning mortgage overages may discourage banks from lending to financially riskier clienteles and first-time customers (who often require additional time in the loan approval process), which may harm African Americans since African Americans tend to have lower credit scores than similarly situated whites and tend not to engage in bargaining or comparison shopping. They conclude that “Thus, policymakers and regulators should not strive to eliminate differential pricing but should concern themselves with those differences that are unrelated to market forces.” One of the essential insights that Black (1999) brings to bear on the discussion of racial discrimination in the financial industry is that increasing competition is often a driving force behind reducing the probability of bias.

About Dr. Black: Harold A. Black, a native of Atlanta, Georgia, received his undergraduate degree from the University of Georgia and his M.A. and Ph.D. degrees from the Ohio State University. He lectures, consults and publishes extensively in the areas of financial institutions and the monetary system. His articles have appeared in publications such as the American Economic Review, Journal of Money, Credit and Banking, Journal of Finance, Journal of Banking and Finance, Southern Economic Journal, Journal of Financial Research and the Journal of Monetary Economics. His consulting clients include some of the nation’s largest financial institutions.

Prior to joining the faculty at the University of Tennessee, he served on the faculties of American University, Howard University, the University of North Carolina – Chapel Hill, and the University of Florida. His government service includes being Deputy Director, Department of Economic Research and Analysis, Office of the Comptroller of the Currency, and Board Member, National Credit Union Administration. He has served as a Director and Chairman of the Nashville Branch of the Federal Reserve Bank of Atlanta. Among his honors, he is the recipient of the Department of Treasury’s Special Achievement Award, the National Urban League’s Outstanding Service Award, the Distinguished Alumnus Award from the University of Georgia’s College of Business Administration, the National Credit Union Administration’s Exceptional Service Award, and the Chancellor’s Award for Research Excellence at the University of Tennessee. Dr. Black was awarded the 2001 John B. Ross Teaching Award for excellence in teaching and is listed in Who’s Who Among Black Americans and Who’s Who Worldwide. Dr. Black writes occasional articles for the Knoxville Focus (knoxfocus.com) and blogs at haroldblackphd.com. The University of Georgia’s Terry College of Business has announced a named professorship in his honor and the University’s new dormitory bears his name.

Sponsors

Probasco Distinguished Chair of Free Enterprise at the University of Tennessee Chattanooga

Haslam College of Business at the University of Tennessee Knoxville

Political Economy Research Institute at Middle Tennessee State University

Supporting Sponsors

UTK Vice Chancellor for Diversity and Engagement

UTK Office of Diversity & Community Relations

University of Mississippi College of Business

MTSU Jones College of Business

MTSU Albert Gore Research Center

MTSU University Honors College

MTSU Weatherford Chair of Finance

MTSU Department of Economics and Finance

Knox County Mayor Glenn Jacobs